فرم مشاوره رایگان

بعد از تکمیل فرم، در اسرع وقت به درخواست شما پاسخ داده خواهد شد.

چرا ما؟

ارائه ایدههای نوین با کیفیت

ارسال سریع با بسته بندی منحصر به فرد

پرداخت ایمن و شرایط مناسب

پشتیبانی 24/7 با حرفهایترین تیم

تنوع در بسته بندی محصولات

پیگیری دقیق از ارسال تا تحویل

تضمین رضایت و کیفیت

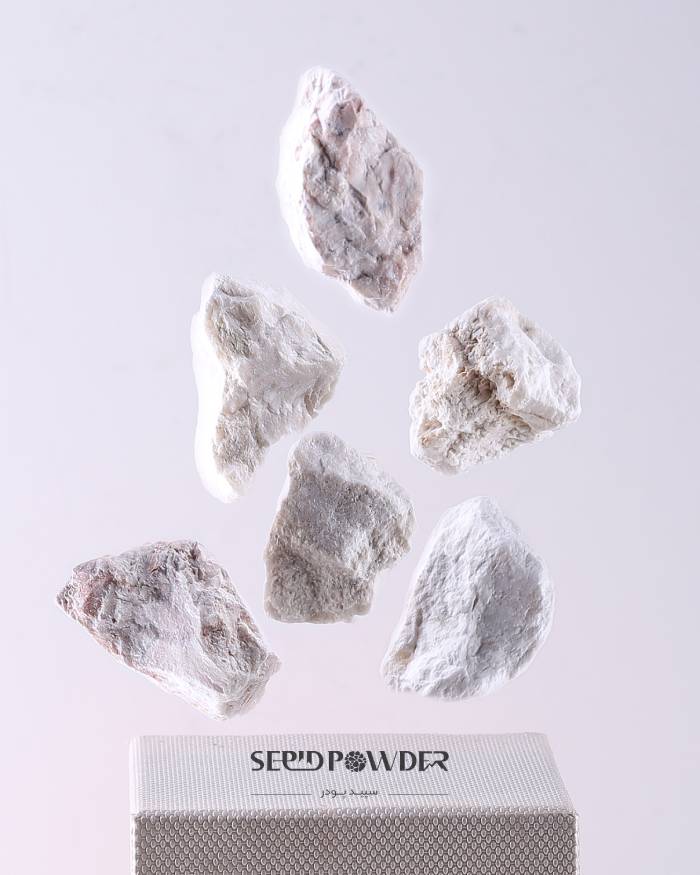

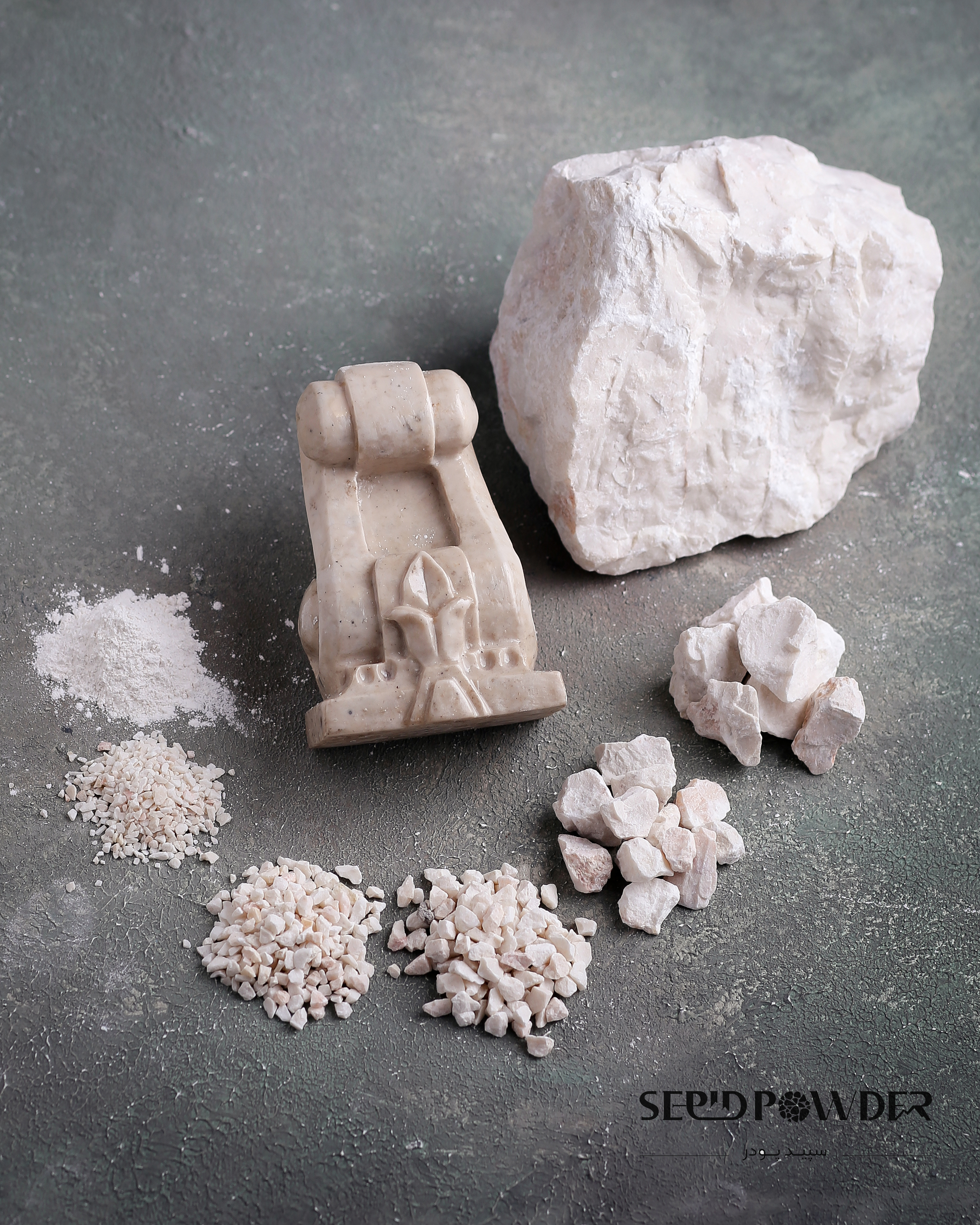

پودر و سنگ دانه بندی شده جوشقان فاز یک کارخانه سنگ کوبی سپید پودر به صورت اختصاصی بر روی سنگ جوشقان و تولید پودر جوشقان و سنگ های دانه بندی شده جوشقان به صورت خالص و با بهترین متریال از بهترین معادن جوشقان با استفاده از تجهیزات پیشرفته سنگ کوبی و اسیاب های حرفه ای در حال فعالیت است. عرضه سفید ترین و خالص ترین پودر جوشقان در نتیجه ی انتخاب بهترین معدن جوشقان و استفاده از خطوط تولید مکانیزه و اسیاب های حرفه ای در شرکت سپید پودر امکان پذیر گردید.با اطمینان میتوان گفت پودر سنگ تولید شده در این مجموعه یکی از بهترین ،خالص ترین و سفید ترین پودرجوشقان عرضه شده در کشور است.

ویژگی های ما

فروش به همکار

فروش به صورت فله ، کیسه، جامبو

سرعت تولید

سریعترین زمان تولید محصولات با تکنولوژی به روز

ثبت سفارش از سرتاسر کشور

تولید بالای محصولات برای سفارشات سنگین

شرکت صنایع سپید پودر جوشقان

در سال 1361 با هدف اکتشاف و بهرهبرداری از مواد معدنی و احداث کارخانه و کارگاه

فرآوری

مواد معدنی و شیمیایی تأسیس گردید و در سال 1387 به طور رسمی کار خود را آغاز نمود.

شرکت سپید پودر جوشقان از نظر ظرفیت و توان تولید در تناژ بالا و کیفیت و قیمت

رقابتی

محصولات در سطح کشور بعنوان نخستین مجموعه صنتعی گسترده در سطح ایران تامین مواد

اولیه بسیاری

از صنایع را برعهده داریم. دسترسی به معادن با کیفیت اختصاصی، حمل و نقل و ارسال

گسترده بار،

صادرات محصولات، تجهیزات و ماشین آلات بهرهبرداری از معادن و خطوط تمام اتوماتیک

تولید محصول

ما را به بزرگترین تولیدکننده فرآوردههای معدنی میکرونیزه ایران تبدیل نموده است.

نظرات مشتریان

"سرویس عالی و امن، توصیه میشود!"

حسن حمیدی"پشتیبانی بی نظیری برای حل مشکلاتمان دارید"

سمیه قنبری"تهیه مصالح با کیفیت خیلی راحت شد"

- علی ذوالفقاری